Gold Price Forecast: XAU/USD remains on track to reclaim $2,000 – Confluence Detector

- Gold was seen consolidating its recent gains to the one-month peak.

- The Ukraine crisis, inflation fears continued lending some support.

- The Fed’s hawkish outlook, the risk-on mood capped the commodity.

Gold held steady near the one-month high set the previous day and continued drawing support from a combination of factors. Investors remain concerned about the potential economic fallout from the Ukraine crisis. This, along with broadening inflationary pressures, boosted the safe-haven metal's appeal as a hedge against rising prices. That said, expectations for a more aggressive policy tightening by the Fed and a generally positive tone around the equity markets kept a lid on any meaningful upside for the metal.

Gold: Key levels to watch

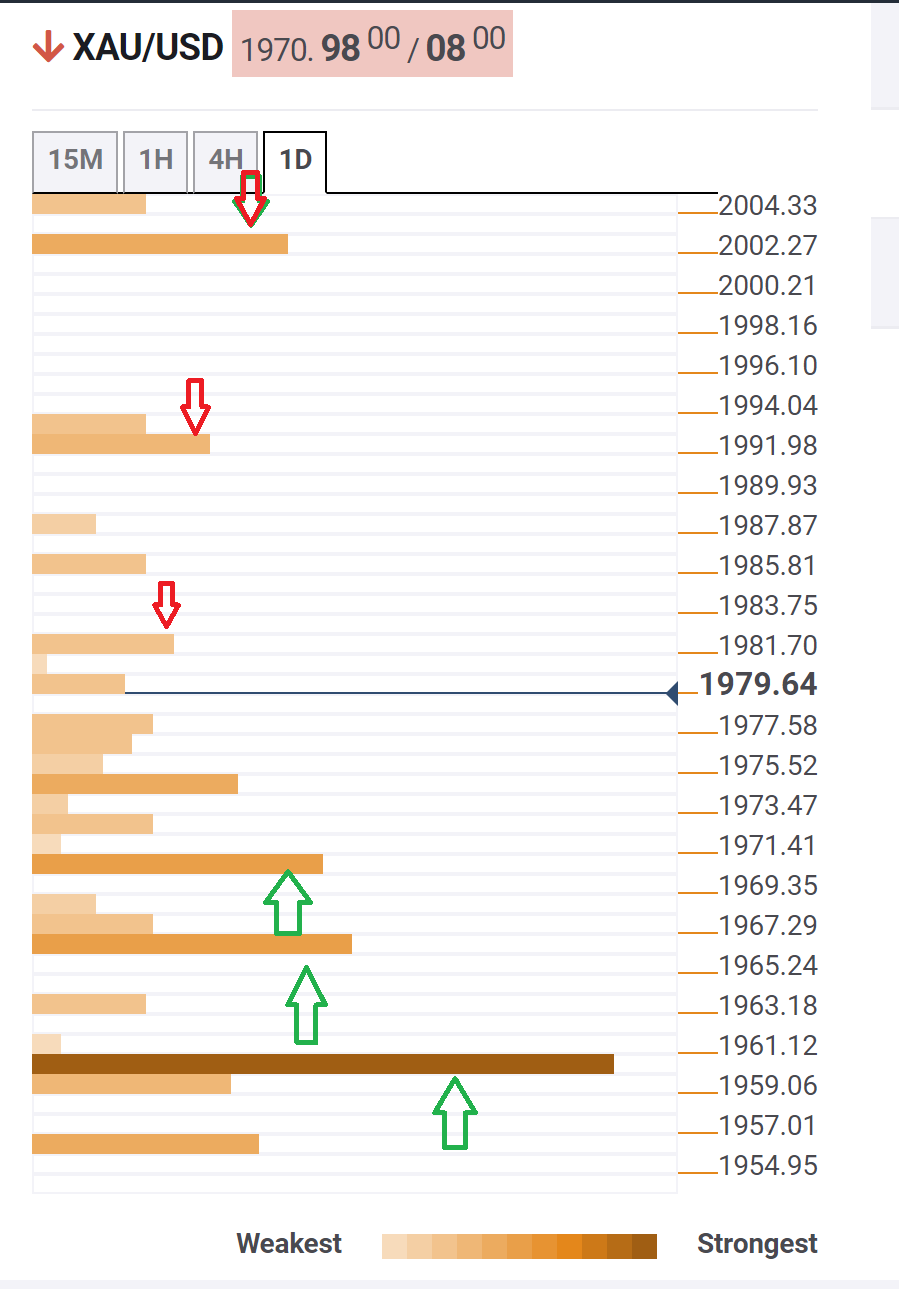

The Technical Confluences Detector shows that any subsequent move beyond the $1,981-$1,982 region (the overnight high) might confront resistance near the $1,992 area - Pivot Point one week R3. The next relevant hurdle is pegged just above the $2,000 psychological mark - the Fibonacci 38.2% one month. A convincing break through the said barriers would be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move.

On the flip side, the $1,974 zone - the Fibonacci 38.2% one day - seems to protect the immediate downside ahead of the $1,970 region - the Fibonacci 61.8% one day and Pivot Point one week R2. The next relevant support is pegged near the $1,960 area - the Fibonacci 61.8% one month. The latter should act as a pivotal point for intraday traders.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.