EUR/USD rebounds from multi-day lows around 1.1370

- EUR/USD regains downside traction and revisits 1.1370.

- The greenback looks bid across the board on mixed US yields.

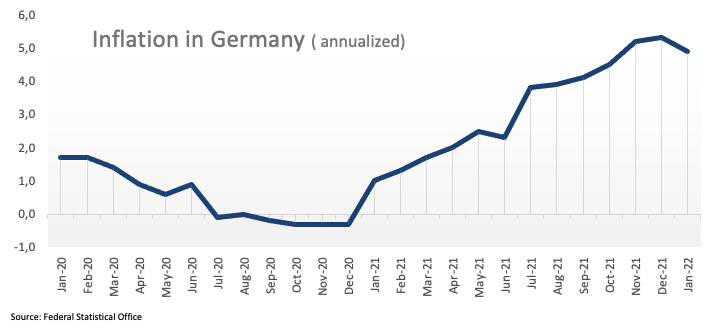

- Final Germany CPI came at 4.9% YoY, 0.4% MoM in January.

The European currency extends the selling bias for the second session in a row and drags EUR/USD to the area of multi-session lows around 1.1370 on Friday.

EUR/USD weaker post-US CPI

After Thursday’s volatile session - where EUR/USD clocked new monthly peaks in levels just shy of 1.1500 the figure - sellers appear to have returned to the market and force the pair to shed more than a cent so far at the end of the week.

While market participants continue to digest the recent multi-decade high in US inflation in January, the mixed tone in yields in the US money markets see the short end of the curve extending gains and retesting the 1.60% mark vs. small retracements in both the belly and the long end. In Germany, yields of the key 10y Bund ease below 0.27% after trespassing the 0.31% on Thursday.

In the domestic calendar, Germany final CPI rose 4.9% in the year to January and 0.4% from a month earlier.

Across the pond, the only release of note will be the advanced Consumer Sentiment print for the current month.

What to look for around EUR

EUR/USD could not sustain the post-US CPI raise to the vicinity of the 1.1500 barrier, sparking a corrective move well south of 1.1400 soon afterwards and on the back of the renewed and quite strong bias towards the US dollar. Despite the ongoing knee-jerk, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region

Key events in the euro area this week: Germany Final January CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is retreating 0.35% at 1.1388 and faces the next up barrier at 1.1494 (2022 high Feb.10) followed by 1.1496 (200-week SMA) and finally 1.1660 (200-day SMA). On the other hand, a break below 1.1370 (weekly low Feb.11) would target 1.1325 (55-day SMA) en route to 1.1121 (2022 low Jan.28).