GBP/CAD Price Analysis: Bears throwing in the towell on profit taking

- Sterling crosses fell heavily on the back of the BoE surprise hold.

- GBP/CAD bears running out of juice into weekly demand territory.

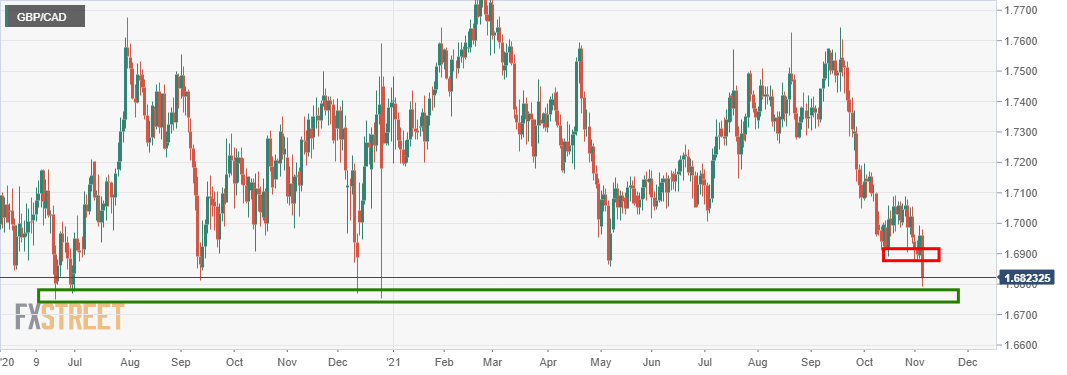

GBP/CAD fell heavily in trade on Thursday following a surprise from the Bank of England that did not raise rates as expected. GBP/CAD fell from a high of 1.6962 to a low of 1.6792 and was ending on Wall Street down some 0.80%. The following, however, illustrate that the path of least resistance, for the time being, is likely to the upside.

GBP/CAD daily charts

The steep drop could be luring bears into a false sense of security at this juncture when zooming out and taking the weekly demand into consideration as follows:

There is a chance that the trend will continue a little while yet, however, 1.6800 marks a central point of demand and the more probable scenario at this juncture is a respite in the current move, especially from a lower time frame perspective, as follows:

GBP/CAD H1 chart

The price fell sharply on the back of the BoE and this leaves a huge imbalance for which would be expected to be filled in coming sessions. The 50% mean reversion target is compelling as it aligns with prior support that would be expected to act as resistance near 1.6880.

Should the area hold, then the downside will be opened again for a retest and bears will be keen to test below 1.68 the figure for a deeper probe of the weekly demand area with 1.6730 in scope.