S&P 500 Index opens modestly higher after US CPI data

- Wall Street's main indexes opened modestly higher on Tuesday.

- Annual core inflation in August edged lower to 4%.

- Energy stocks gain traction with crude oil trading in the positive territory.

Following Monday's choppy session, major equity indexes in the US opened higher on Tuesday as investors are assessing the August inflation data. As of writing, the S&P 500 Index was up 0.22% on the day at 4,478, the Dow Jones Industrial Average was rising 0.2% at 34,940 and the Nasdaq Composite was gaining 0.27% at 15,146.

The US Bureau of Labor Statistics announced on Tuesday that the Core Consumer Price Index (CPI) declined to 4% on a yearly basis in August from 4.3% in July. This reading came in lower than the market expectation of 4% and revived expectations for a delay in the Federal Reserve's reduction of asset purchases.

Among the 11 major S&P 500 sectors, the Energy Index is up 0.5% after the opening bell supported by a 0.6% increase in US crude oil prices. On the other hand, the Industrials Index is losing 0.2% as the biggest decliner in the early trade.

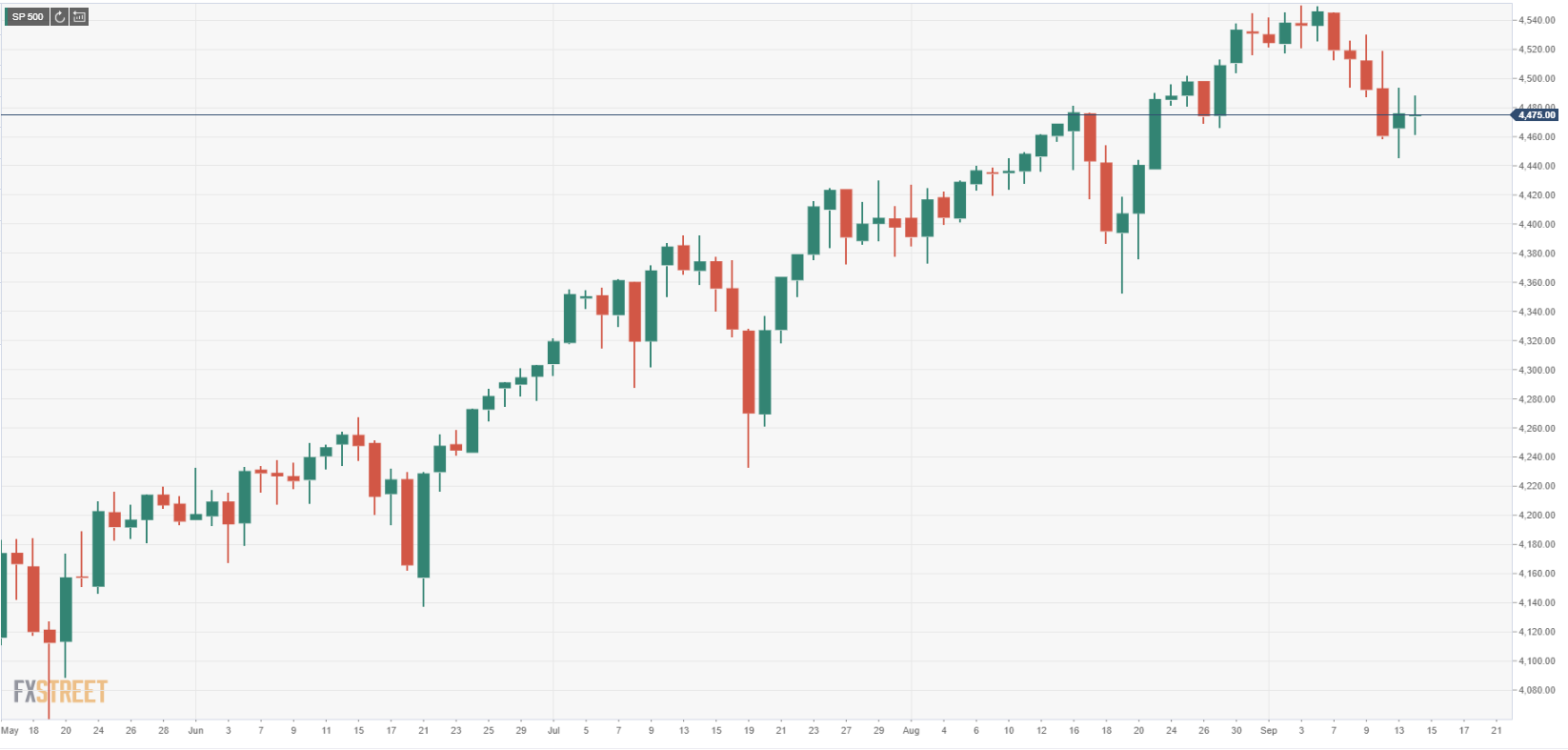

S&P 500 chart (daily)