Silver is pressured amid US dollar bulls

- Silver is pressured by a resurfacing US dollar in the forex space.

- Fed expectations harden towards a hawkish bias in Fed speakers before NFP Friday.

After losing 0.5% yesterday, the price of XAG/USD is shedding 0.22% in Asia, drifting from a high of $25.40 to a low of $25.31 and counting.

Fed speakers have been crossing the wires of late, raising a hawkish that has given support to the US dollar and capping metals in familiar ranges.

Fed's Bullard was speaking at a Wall Street Journal event and said that he thinks inflation will be more persistent than some people think. He now sees it at 2 1/2% to 3% in 2022.

Meanwhile, Fed's Vice Chair Richard Clarida said that he is expecting conditions for raising rates to be met by the end of 2022.

The greenback had found form again despite US ADP data missing heavily in July by 330,000 vs the 695K estimated.

In the US session, the US 10-year yields were higher to 1.2140% after they started the session sharply lower near 1.1270% which lifted the Us dollar index, DXY, through the key 92.20 level to reach a high, so far, or 92.325 in Asia.

''The data was at odds with record numbers of jobs vacancies and we’d be cautious in reading too much into the number ahead of Friday’s payrolls data,'' analysts at ANZ Bank said.

''The sector with the largest job gains was leisure and hospitality (139k), reflecting the ongoing reopening of the economy.''

However, the question following the data is whether it foreshadows a more critical jobs report this Friday.

Should the Nonfarm Payrolls data underwhelm, then a break of 91.80 DXY is probable and would be a lift for precious metals.

DXY northerly trajectory

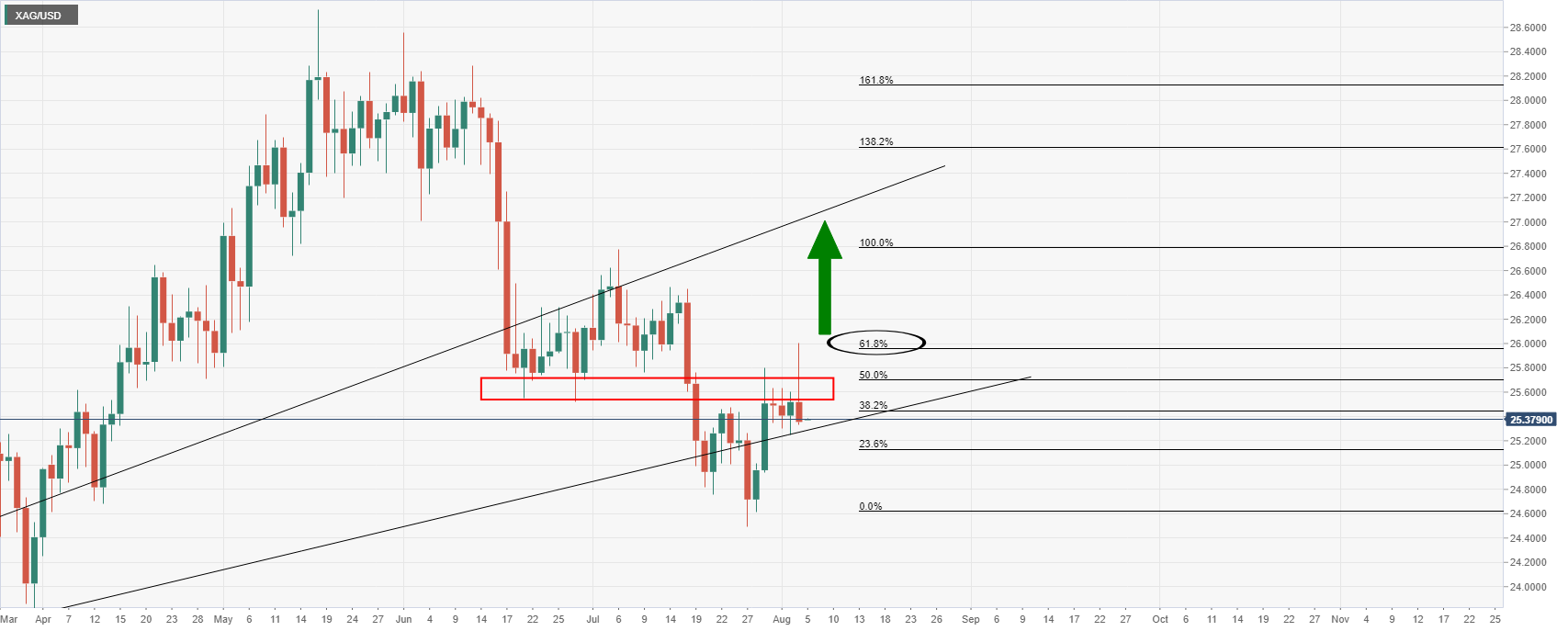

Silver technical analysis

However, the bar is low for a slide further slide should the US data continue to feed the inflation narrative.

Daily chart

Hinged to the mid-July resistance near 25.50, the white metal fails to break from the dollar's firm grip.

A break above the 61.8% Fibo near 25.90 of the weekly bearish impulse will open the avenue to the weekly counter-trendline.

Weekly chart