EUR/JPY Price Analysis: Bulls testing bearish commitments at critical resistance

- EUR/JPY bears are eyeing a significant downside correction on the monthly time frame.

- The price is testing a critical daily and 4-hour resistance area.

The following is a bearish perspective of the current market structure in EUR/JPY across the time frames, from the monthly chart all the way down to the 4-hour chart.

Monthly chart

The price has broken below monthly dynamic support that would now be expected to act as a counter trendline while price moves back to test the old resistance in a 61.8% Fibonacci retracement near 127.00.

Weekly chart

The weekly chart shows that the price is leaving a bearish wick and should the week close with a lower weekly closing low, then the wick would be expected to be filled on the lower time frames in due course.

Daily chart

Meanwhile, from a daily perspective, the price has corrected into resistance which is so far holding up.

Expectations are for a downside continuation at this juncture.

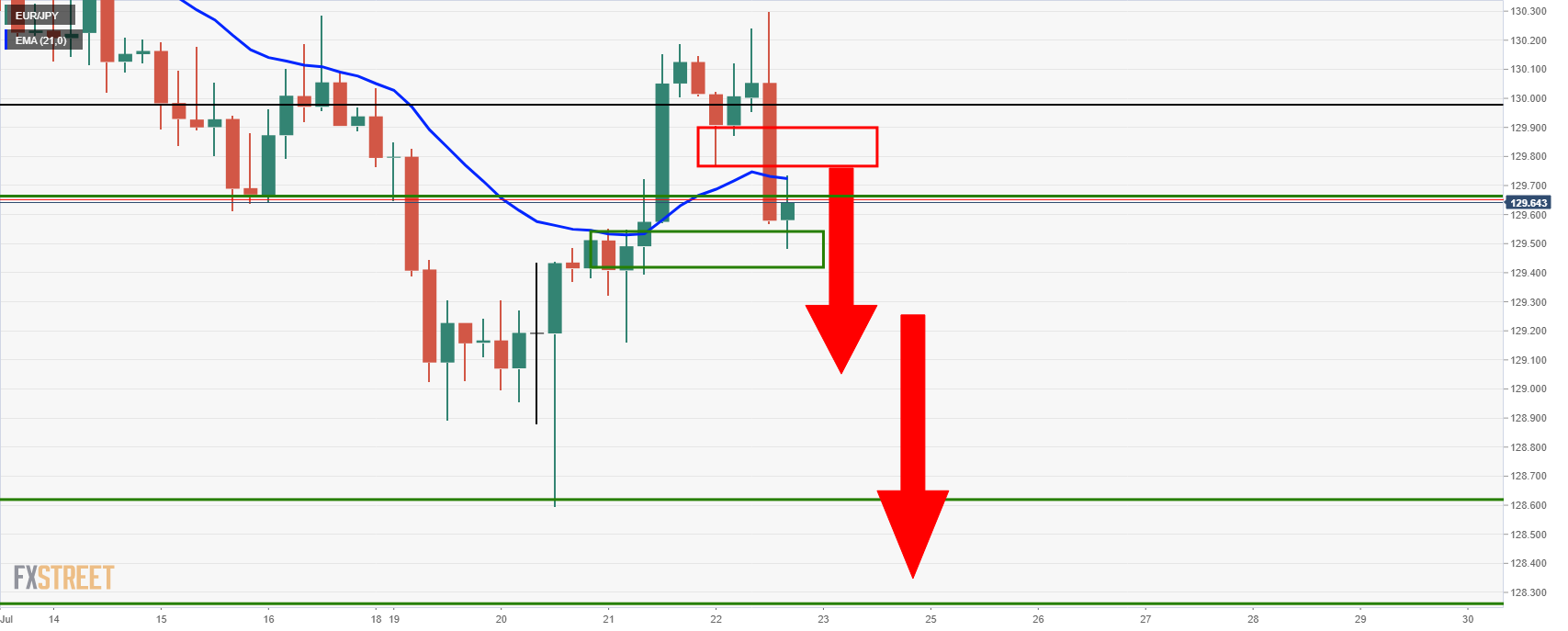

4-hour chart

From the 4-hour chart, we can see that the price is moving in on the 21-EMA and prior lows which are the neckline of the M-formation.

This are would be expected to act as resistance, resulting in a move to the downside and towards the monthly target area over time.