Back

31 May 2021

Crude Oil Futures: Probable retracement near-term

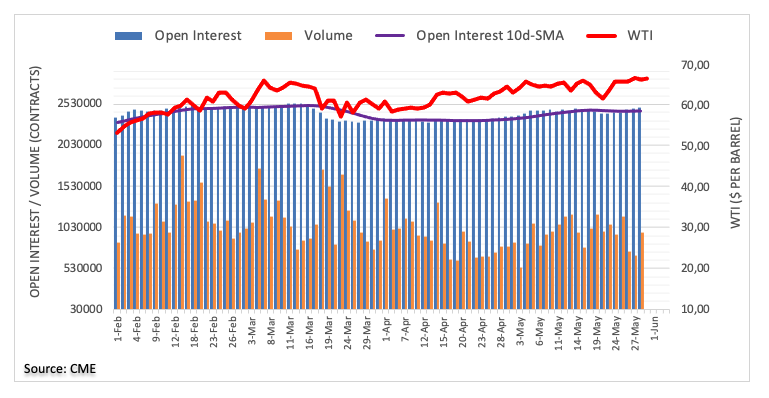

CME Group’s flash data for crude oil futures markets noted open interest extended the uptrend for yet another session on Friday, this time by nearly 11K contracts. Volume, followed suit and went up markedly by around 284K contracts after two daily pullbacks in a row.

WTI still looks to $68.00

Friday’s pullback in prices of the WTI was accompanied by increasing open interest and volume, allowing for further decline in the very near-term. Once the correction is over, crude oil prices are expected to resume the upside to, initially, the 2021 highs near the $68.00 mark per barrel.