Gold Price Analysis: XAU/USD bulls challenge 200-period SMA, around $1,735 region

- A softer risk tone, retreating US bond yields assisted gold to gain traction on Tuesday.

- A modest pickup in the USD demand kept a lid on any further gains for the commodity.

- The set-up favours intraday bullish traders, through mixed oscillators warrant caution.

Gold held on to its modest intraday gains through the mid-European session and was last seen hovering near two-week tops, just above the $1,735 level.

A generally softer risk tone, along with declining US Treasury bond yields extended some support to the non-yielding yellow metal. However, a goodish pickup in the US dollar demand held bulls from placing aggressive bets and might cap gains for the dollar-denominated commodity.

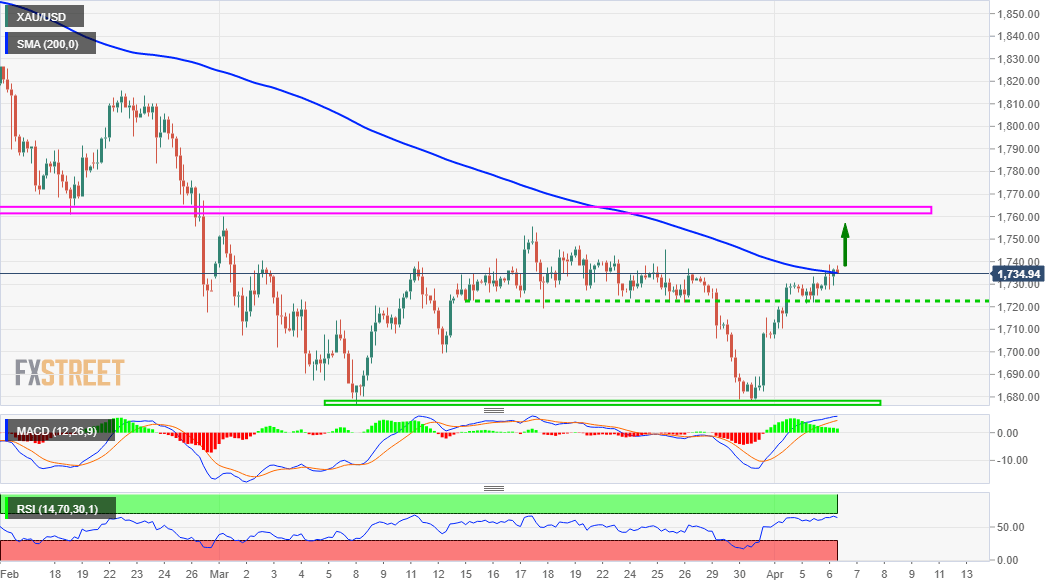

From a technical perspective, the XAU/USD bulls might now be looking to build on the momentum further beyond the 200-period SMA on the 4-hour chart. This is closely followed by the $1,744-46 supply zone, which if cleared decisively will be seen as a fresh trigger for bullish traders.

Meanwhile, technical indicators on hourly charts have been gaining positive traction but are yet to confirm a bullish bias on the daily chart. This, in turn, warrants some caution for aggressive bullish traders and positioning for any further appreciating move for the XAU/USD.

Hence, any subsequent move up is more likely to confront a stiff resistance near a previous strong horizontal support breakpoint, around the $1,760-65 region. The mentioned barrier also the neckline of a bullish double-bottom pattern and should act as a key pivotal point for traders.

On the flip side, immediate support is pegged near the $1,720 level. This is followed by the $1,700 round-figure mark, which if broken will negate the constructive set-up. The XAU/USD might then accelerate the downfall to challenge multi-month lows, around the $1,677-76 region.

XAU/USD 4-hour chart

Technical levels to watch