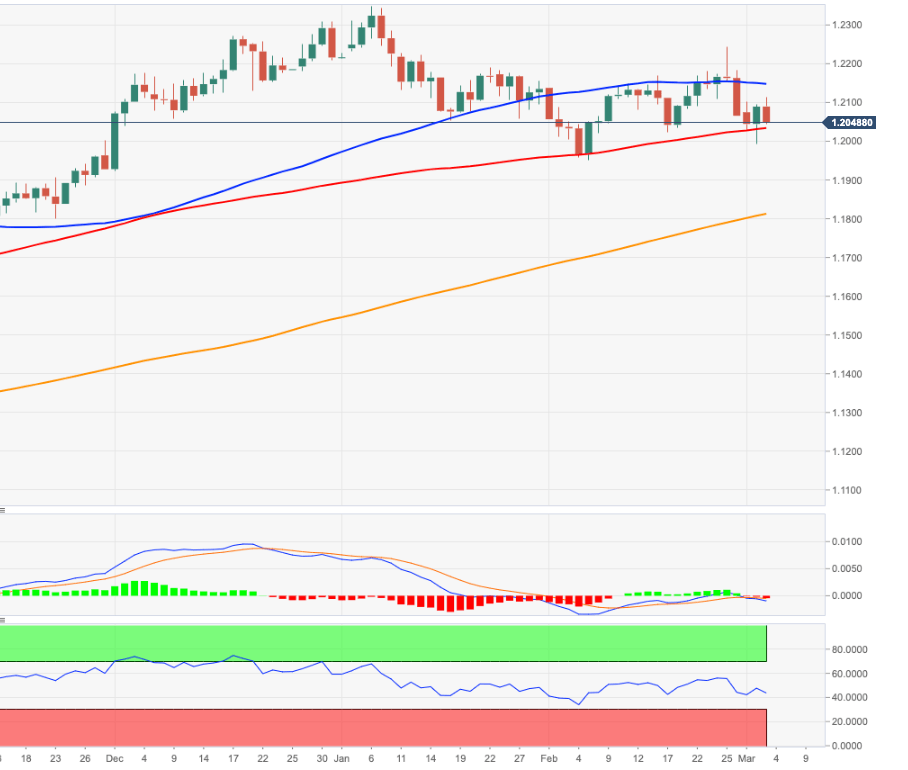

EUR/USD Price Analysis: A drop to 2021 lows stays on the cards

- EUR/USD resumes the downside after surpassing 1.2100.

- A deeper pullback could reach the 2021 low at 1.1952.

EUR/USD fades Tuesday’s decent advance and shift its focus back to the downside and to a potential re-test of the 1.2000 neighbourhood.

Despite the ongoing weakness is seen as temporary, it could extend further and attempt to revisit the YTD lows in the mid-1.1900s (recorded in early February) if 1.2000 is breached in a sustainable fashion. Below yearly lows the selling pressure is expected to pick up pace, exposing the next target at the Fibo level at 1.1887.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1799.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart