Back

11 Jan 2021

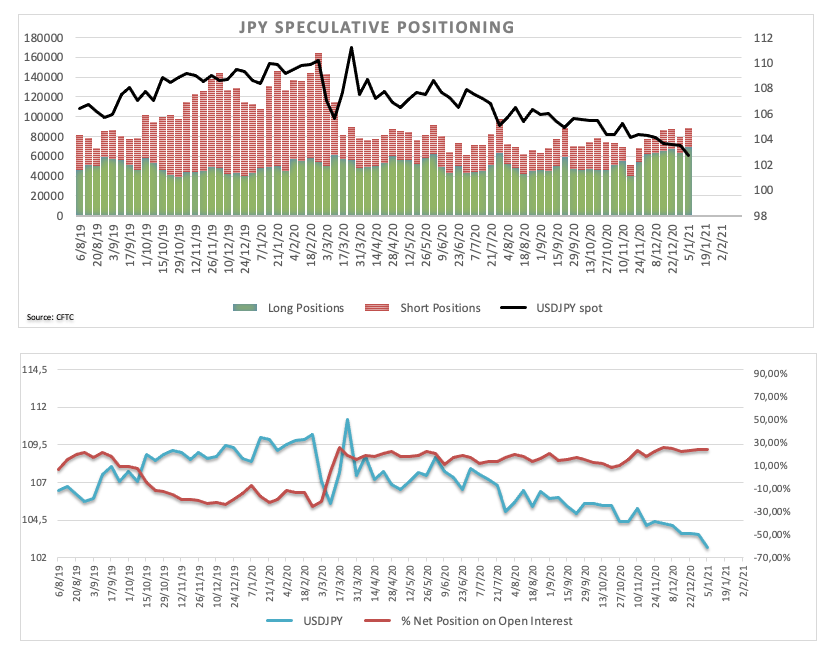

CFTC Positioning Report: JPY net longs in multi-year highs

These are the main highlights of the CFTC Positioning Report for the week ended on January 5th:

- Speculators took the net longs in the Japanese yen to the highest level since early October 2016. In fact, investors continued to gauge the global ultra-low interest rate context vs. the potential repatriation and renewed focus on domestic assets.

- USD net shorts increased to levels last observed in mid-March 2020 amidst increasing likelihood of extra US fiscal stimulus under the Biden’s presidency, the ongoing vaccine rollout and hopes of a solid recovery in the global economy.

- Net longs in EUR receded to 3-week lows against the backdrop of rising concerns over the advance of the pandemic in the Old Continent and tighter restrictions in many major economies, which could temper the economic recovery in the next months.

- The better tone in the risk complex coupled with the recovery in the Chinese economy and higher crude oil prices dragged net shorts in AUD to levels recorded in early November 2020.