Gold Price Analysis: XAU/USD off lows, $1900 still at risk ahead of NFP

- Gold is off the lows but not out of the wood yet.

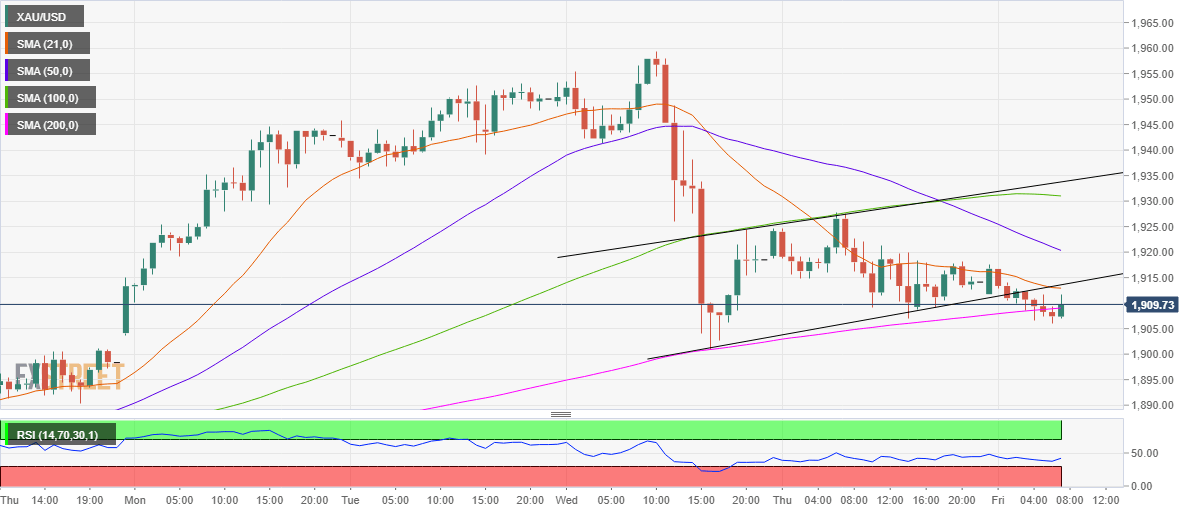

- Recaptures 200-HMA, RSI still remains in the bearish zone.

- Rising channel breakdown on 1H keeps the sellers hopeful.

Gold (XAU/USD) has bounced-off a dip to near the $1906 region, as the bulls attempt a tepid recovery above the 200-hourly moving average (HMA), currently at $1909.

Despite the pullback, gold’s path of least resistance appears to the downside, especially after the price confirmed a rising channel breakdown on the hourly chart in the Asian trades.

Gold Price Chart: Hourly

Bears eye a break below the critical $1900 level to accelerate the downside. Further south, the previous week low of $1869 could be tested.

Meanwhile, the bearish bias will remain intact so long as the price holds below powerful resistance aligned around $1913, which is the confluence of the bearish 21-HMA and the channel support now resistance.

The next line of defense for the bears is seen at the downward-sloping 50-HMA at $1920.

The Relative Strength Index (RSI) has witnessed an uptick in the last hour, although remains below the 50 level, supporting the case for lower levels.

Gold Additional levels