Silver Price Analysis: Eases from three-month high above $18.00

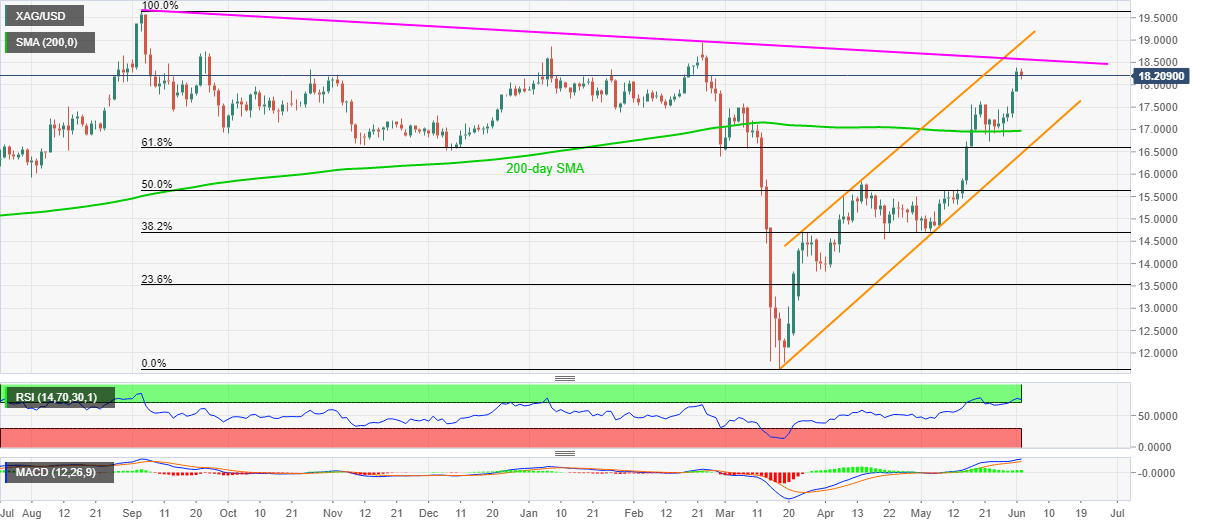

- Silver prices step back from $18.39 amid overbought RSI conditions.

- Bulls remain optimistic above 200-day SMA, 11-week-old rising channel also favors the upside momentum.

- A nine-month-long descending trend line is on the buyers’ radars.

Silver prices drop 0.50% from the three-month high of $18.39 to $18.20 amid the early Tuesday’s trading.

Although overbought RSI conditions suggest a pullback of the white metal to May 20 high near $17.63, the further downside might find it difficult to break a 200-day SMA level of $16.97.

If at all the sellers manage to break 200-day SMA on a daily closing basis, 61.8% Fibonacci retracement of September 2019 to March 2020 fall, around $16.60, can restrict additional declines.

Meanwhile, the bulls’ dominance past-$18.39 will them towards a multi-day-old falling resistance line near $18.57 ahead of highlighting the said channel’s resistance around $18.95.

It’s worth mentioning that the bullion’s sustained rise above $18.95 enables it to refresh the yearly top while also probing September 2019 peak near $19.65.

Silver daily chart

Trend: Pullback expected