Germany's DAX 30 Index: Losing ground as global coronavirus cases top 800,000

- The German DAX 30 stock index is off the highs amid coronavirus headlines.

- End-of-quarter flows may trigger high volatility.

- Coronavirus headlines and other developments are eyed.

The DAX 30, Germany's leading stock index, has been paring its gains as the last day of the first quarter draws to an end. The early gains have been eroded amid coronavirus headlines.

According to Johns Hopkins University, the global number of cases has topped 800,00, with over 38,000 deaths. The respiratory disease has crushed stocks-- including those in Frankfurt – throughout the quarter.

Infections in Germany have surpassed 67,000 with 650 mortalities. The eurozone's largest economy has initially experienced a relatively low death rate in comparison to other European countries. This phenomenon had to to with the country performing more tests than others, and a younger profile of sick people.

German economic figures are yet to reflect the economic downturn. The number of the unemployed is barely changed, yet officials in Berlin used data running through March 12, before the worst of the crisis hit.

Later in the day, US Covid-19 statistics and the Conference Board's consumer confidence gauge for March are on the cards. Moreover, when trading opens in Wall Street, the German DAX 30 is likely to move in a higher correlation with American indexes.

Last-minute portfolio adjustments may also have a considerable impact on the index.

Germany's DAX 30 realtime

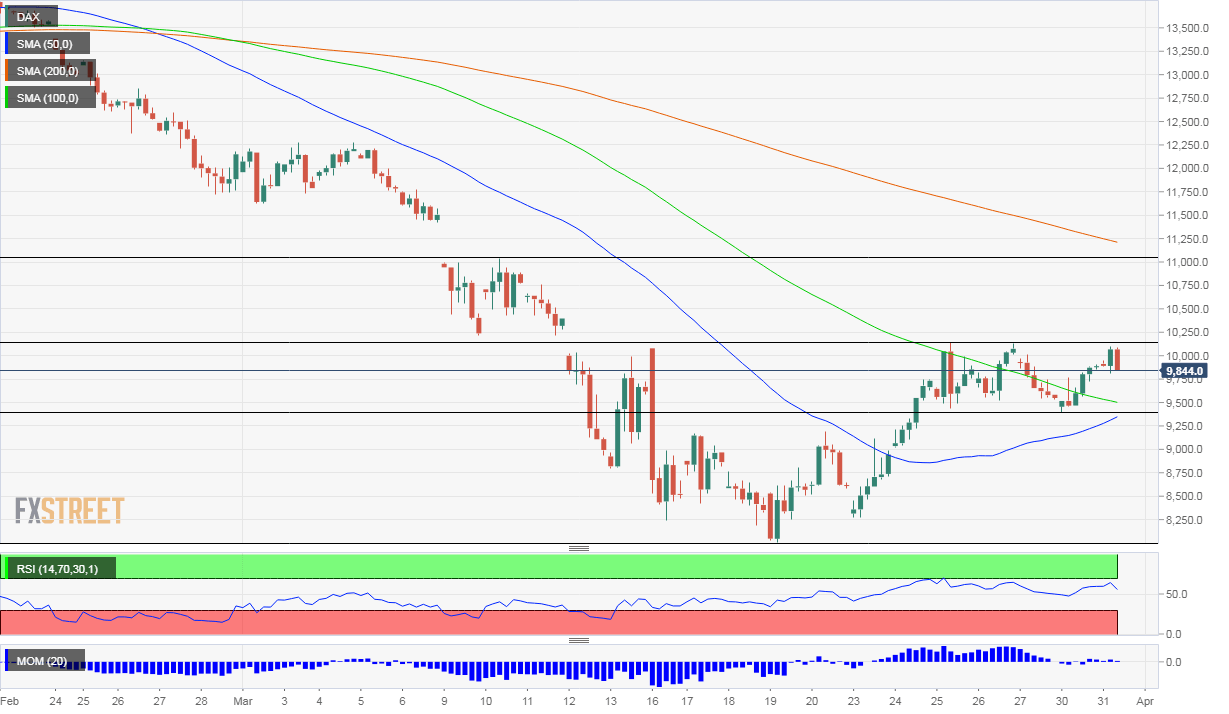

The 10,156 level has proved to work as robust resistance. Support awaits at around 9,400. Other levels to watch are 8,000 and 11,000, which were notable for the DAX during March.