Back

27 Mar 2020

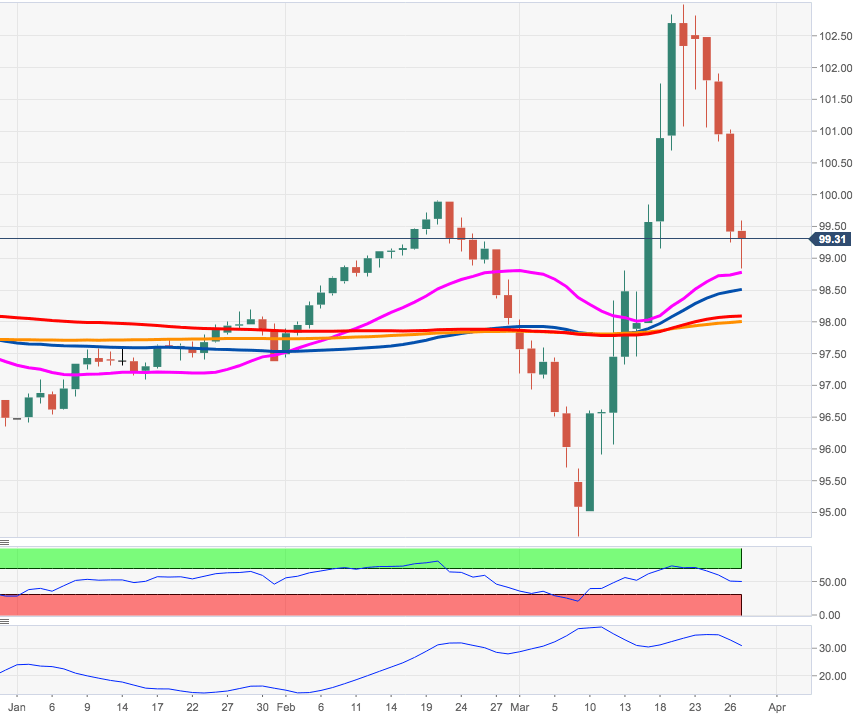

US Dollar Index Price Analysis: Scope for a move to 98.00

- DXY continues to correct lower after failing just below 103.00.

- Extra losses remain on the cards and could extend to the 98.00 region.

DXY accelerated the downside after breaking below the key triple-digit support, briefly printing fresh lows near 98.80 just to rebound afterwards.

If the selling impetus gathers traction, then a potential test of the key 200-day SMA in the 98.00 region could return to the investors’ radar.

So far, the positive outlook in the buck remains unchanged as long as the 200-day SMA, holds the downside.

DXY daily chart