Back

3 Mar 2020

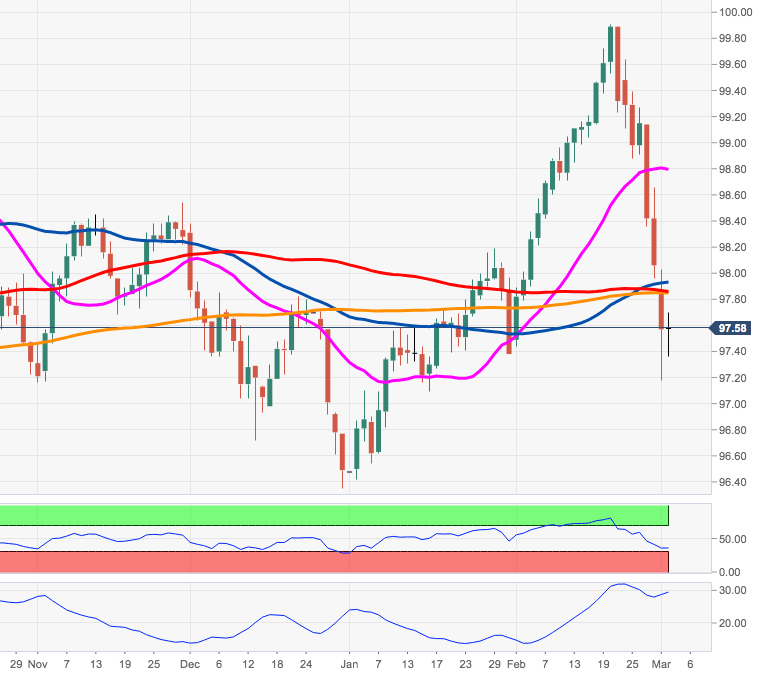

US Dollar Index Price Analysis: Further weakness aligns below the 200-day SMA

- DXY extends the leg lower well below the 98.00 level, or 7-week lows.

- While the 200-day SMA at 97.83 caps the upside, further losses are likely.

DXY is alternating gains with losses on Tuesday, looking to reverse the heavy downside pressure seen in past sessions.

After breaking below some interim supports at Fibo retracements and the key 200-day SMA, the index has now opened the door to a deeper decline.

That said, a move to the December 2019 low at 96.36 should not be ruled out, particularly against the current backdrop of rising speculations of a coordinated measure to battle the COVID-19 impact on the economy.

DXY daily chart