EUR/USD hovering around 1.1040 post-EMU CPI

- EUR/USD keeps the range on EMU CPI results.

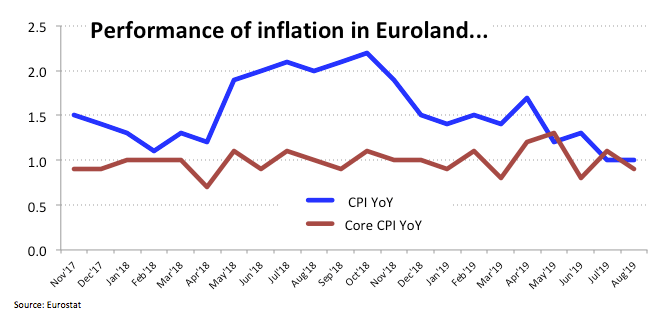

- EMU flash CPI came in at 1.0% in August.

- German Retail Sales contracted more than expected in July.

There is no change around the single currency so far today, with EUR/USD navigating the lower end of the range near 1.1040.

EUR/USD apathetic on inflation data

The pair keeps the negative mood unaltered so far on Friday after advanced inflation figures gauges by the CPI in Euroland showed headline consumer prices are expected to gain 1.0% on a year to August. In addition, prices stripping food and energy costs are seen inching higher at an annualized 0.9% (a tad below estimates).

Spot has practically ignored the results, somewhat expected after German flash CPI surprised to the downside on Thursday.

These data do nothing but support the idea of the majority of the ECB members to pump in some fresh monetary stimulus in the euro area in order to not only revive the upside traction in inflation but also to help tackling the unremitting economic slowdown.

Later in the NA session, US inflation figures measured by the PCE (the Fed’s favourite gauge) are due along with Personal Income/Spending at the final U-Mich print for the month of August.

What to look for around EUR

Spot remains on the defensive amidst the better tone in the buck and somewhat renewed optimism on the US-China trade front. Today’s lack of surprise from flash inflation figures in the euro area added to recent disappointing results from German CPI, all reinforcing the case for extra monetary stimulus by the ECB (likely to be delivered next month). This view is also expected to keep occasional bullish attempts well contained for the time being. On the political front, positive developments from Italy have been utterly ignored by investors so far.

EUR/USD levels to watch

At the moment, the pair is losing 0.12% at 1.1043 and faces immediate contention at 1.1026 (2019 low Aug.1) seconded by 1.0839 (monthly low May 11 2017) and finally 1.0569 (monthly low Apr.10 2017). On the upside, a breakout of 1.1125 (21-day SMA) would target 1.1186 (61.8% Fibo of the 2017-2018 up move) en route to 1.1196 (55-day SMA).