When are the US durable goods orders and how could they affect EUR/USD?

US durable goods orders overview

Friday's US economic docket highlights the release of durable goods orders data for the month of April. The US Census Bureau is scheduled to release the monthly report at 12:30 GMT, with consensus estimates pointing to a sharp decline of 2.0% during the reported month as against a solid growth of 2.8% recorded in the previous month. Excluding transportation items - core durable goods orders, which tend to have a broader impact than the volatile headline figures are anticipated to rise a modest 0.2% in April, matching the previous reading.

As Analysts at TD Securities explain: “A large decline in the nondefense aircraft segment (driven by Boeing woes) and a drop in vehicles orders are likely to drag the headline measure lower. We also pencil in a -0.4% m/m retreat in durable goods ex-transportation and a larger -0.8% slide in core capex orders.”

Deviation impact on EUR/USD

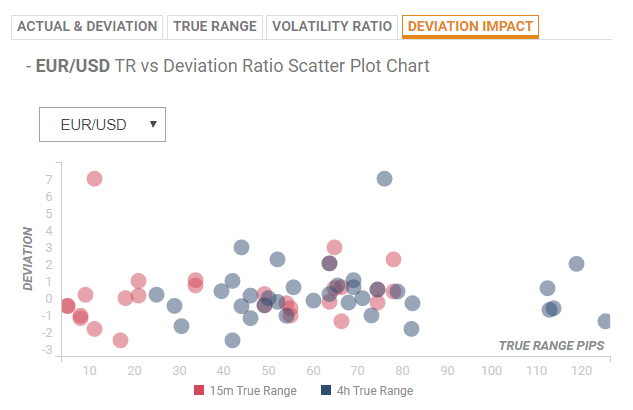

Readers can find FX Street's proprietary deviation impact map of the event below. As observed, the reaction is likely to be in the range of 20-25 pips during the first 15-minutes in case of a deviation from +0.36 to -0.51 and could extend up to 51-55 pips in the following 4-hours.

EUR/USD important levels to watch

Yohay Elam, FXStreet's own Analyst offers some important technical levels ahead of the important release: “Resistance awaits at 1.1225 that separated ranges in mid-May, capping the currency pair last week. The next line to watch is 1.1250 that held it down earlier in the month, and the most substantial level is 1.1265, a double top. 1.1325 is next.”

“Support awaits at 1.1190 that was a resistance line early this week. 1.1165 provided support in mid-May and the new 2019 low of 1.1107 is the next level to watch,” he added further.

Key Notes

• US Durable Goods Orders Preview: Sentiment is not enough

• EUR/USD clings to gain, stays sidelined below 1.1200

• EUR/USD Technical Analysis: Interim resistance emerges at the 55-day SMA at 1.1236

About US durable goods orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.