Back

15 Apr 2019

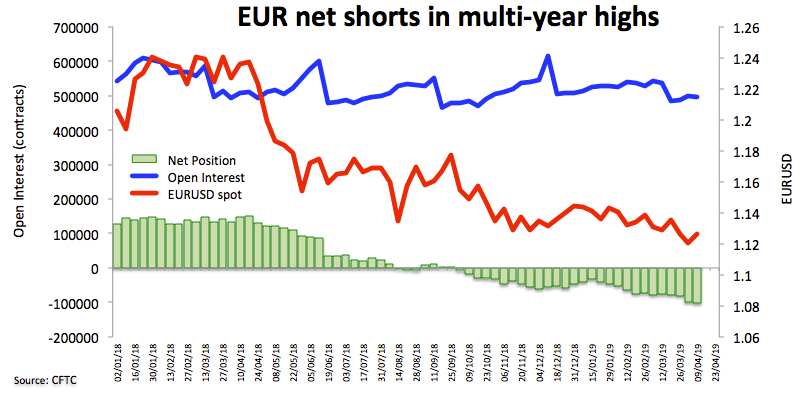

CFTC positioning report: EUR net shorts climbed further

- Speculators increased their net short position to the highest level since early December 2016 above 102K contracts during the week ended on April 9, as investors kept adjusting to the dovish message from the ECB.

- On the USD side, net longs increased to 4-week highs just below 30K contracts, with gross longs and shorts changing just a little. Investors seem to be more focused on the health of the US economy, leaving the Fed’s stance on the back seat for the time being.

- GBP net shorts shrunk to the lowest level since June 2018 around 6.5K contracts, pari passu with the rally in Cable. Of note, however, is the sharp decline in open interest since March, which warns against the continuation of the up move and could favour some near term consolidation.

- VIX net shorts increased further, reaching the highest level since mid-October 2017. The sharp build of short positions in the ‘panic index’ falls in line with lack of direction in the global markets as well as the extremely thin trade conditions seen in past months.