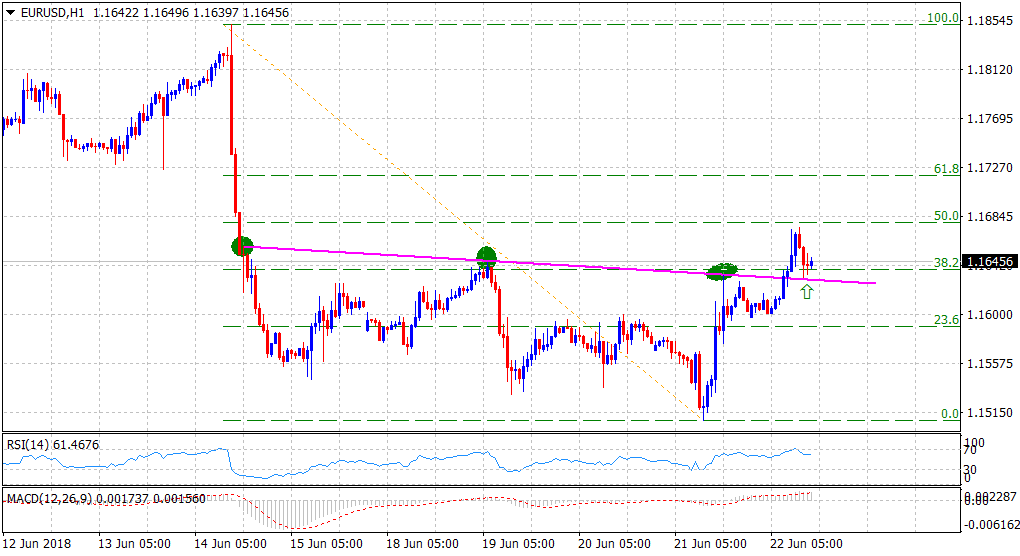

EUR/USD Technical Analysis: retreats to retest an important resistance break-point

• Retreats from 50% Fibonacci retracement level of the post-ECB slide to retest a resistance break-point turned support.

• A sustained move above the 1.1675-80 region would be needed for the pair to continued with its overnight recovery move from YTD lows.

• Weakness below the resistance turned support, and a subsequent break below the 1.1600 handle (nearing 23.6% Fibonacci retracement level) would negate prospects of any further recovery.

EUR/USD 1-hourly chart

Spot Rate: 1.1646

Daily Low: 1.1598

Daily High: 1.1675

Trend: Bullish only until holds above 1.1600 handle

Resistance

R1: 1.1675 (current day high)

R2: 1.1708 (R2 daily pivot-point)

R3: 1.1733 (200-period SMA H4)

Support

S1: 1.1630 (resistance break-point)

S2: 1.1599 (5-day SMA)

S3: 1.1582 (daily pivot-point)