US Dollar Index rises late Friday and extends weekly gains

The US dollar gained momentum during the second half of the American session and rose across the board, amid a recovery in Wall Street and rising US bond yields. The movement took place despite the lower-than-expected NFP.

In the Wall Street, the Dow Jones turned positive and near the end of the week it was up 0.10% at 20,680; overnight it bottomed at 20,520. In the bond market, the 10-year yield bottomed at 2.270%, the lowest in four months and then reversed sharply, rising to 2.375%.

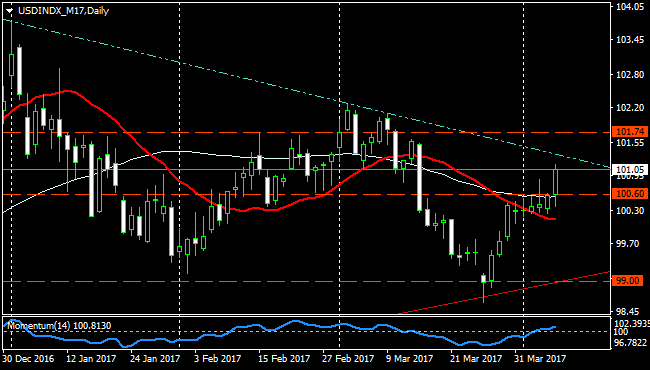

The moves in the bond market boosted the greenback. The US dollar index was trading flat, around 100.70 and broke higher. It rose above 101.00 and peaked at 101.14, the highest level since March 14. Near the end of the week, it was trading at 101.05, up 0.85% for the week. It is the second weekly gain in a row for the DXY, that continues to rebound from a long-term trendline.

Friday started with the US air strike in Syria, that triggered risk aversion. Then the US employment report showed that the economy added 98K jobs, significantly below the expected 180K. But risk appetite re-appeared on the market during the American session and weakened the Japanese yen.

Job Gains, Growth and Wage Fundamentals - Wells Fargo

Next week in the US

The key report next week will be on Friday the March inflation report. “Although headline inflation has been accelerating since last year, core inflation has remained relatively flat at 2.3%. We estimate CPI core increased 0.2% m/m, implying an increase of 2.3% y/y while the headline figure is likely to have increased 0.1% m/m, implying an increase of 2.8% y/y. Thus, we expect to see the acceleration in inflation turn into a deceleration”, said analysts from Danske Bank.

Also, the retail sales report is due next Friday, when US market will be closed for Good Friday.