USD/MXN 'coin toss' pause at 20.30; Mexico's Guajardo doubts boarder tax

Currently, USD/MXN is trading at 20.64, up +0.54% or 987-pips on the day, having posted a daily high at 20.74 and low at 20.53.

Mexico's Economy Minister Guajardo was on the wires, via Reuters, as he doubts the proposed 'border tax' on Mexican imports will carry on. Furthermore, is unclear if such proposal has President Trump's focus and attention.

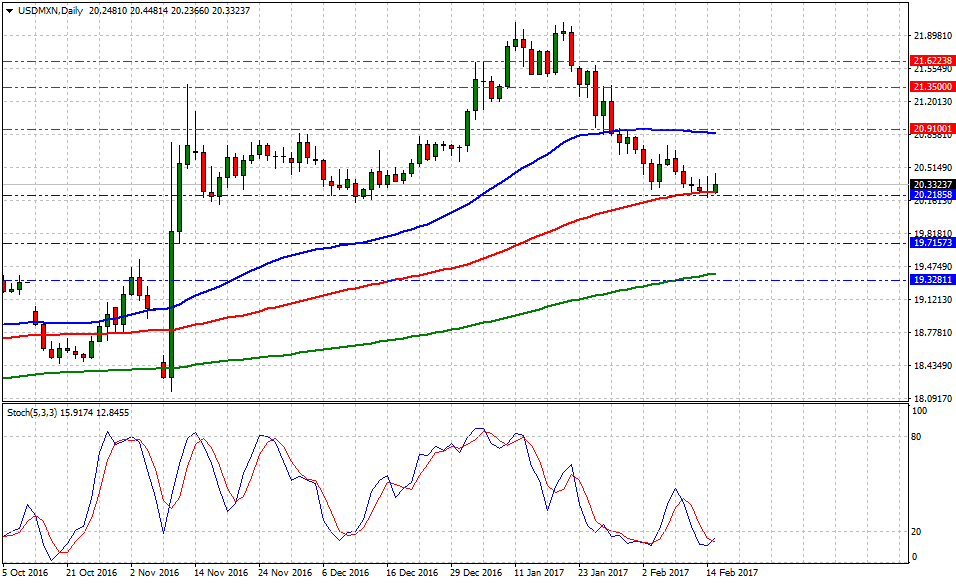

The American dollar vs. Mexican Peso has been traded sideways over the last 10-consecutive trading sessions as the exotic currency kept drifting lower towards 100-DMA. On the US data front, the Consumer Price Index boosted the greenback buying impetus on US Majors, however, it failed to move the peso lower.

Historical data available for traders and investors indicates during the last 7-weeks that USD/MXN, a commodity-linked and exotic currency, had the best trading day at +1.83% (Jan.10) or 3983-pips, and the worst at -2.22% (Jan.25) or (4684)-pips.

Technical levels to watch

In terms of technical levels, upside barriers are aligned at 20.89 (50-DMA), then at 21.38 (high Jan.27) and above that at 21.58 (high Jan.25). While supports are aligned at 20.24 (low Feb.10), later at 19.72 (low Nov.10) and below that at 19.11 (low Nov.3). On the other hand, Stochastic Oscillator (5,3,3) seems to extend the bearish trajectory, but a bottom should be expected around the corner. Therefore, there is evidence to expect further US dollars gains in the near term.

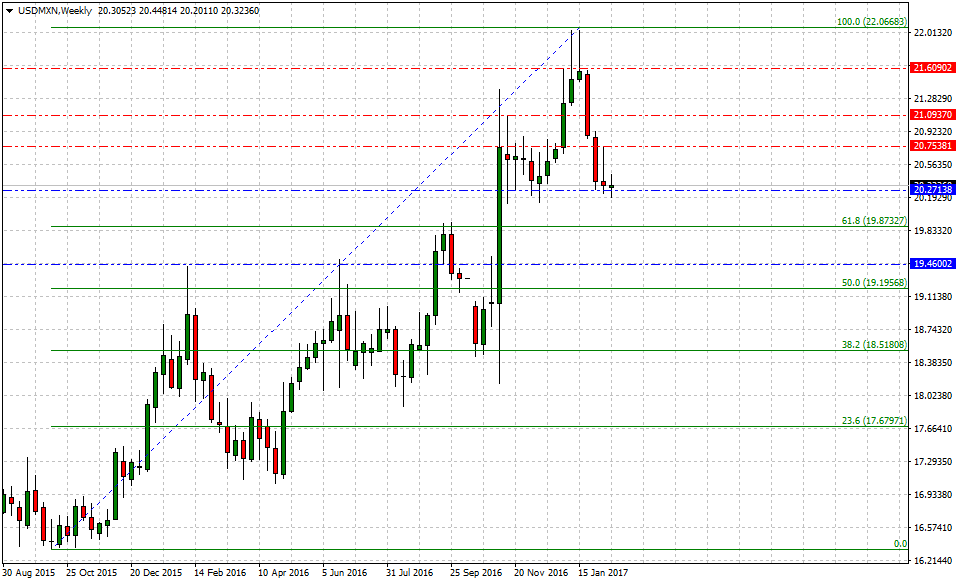

On the medium-term view, if 22.03 (high Jan.15) is in fact, the top during the first semester in 2017, then traders and investors would have allocated risk around the following support levels: 20.28 (low Jan.29), then at 19.87 (short-term 61.8% Fib) and finally below that at 19.19 (short-term 50.0% Fib) . On the other hand, upside barriers are aligned at 20.92 (high Jan.29), later at 21.09 (high Nov.12) and above that at 21.58 (high Jan.22).

CPI Jumps in January, but Trend Looks More Moderate