Back

13 Oct 2022

Crude Oil Futures: Downside appears overdone

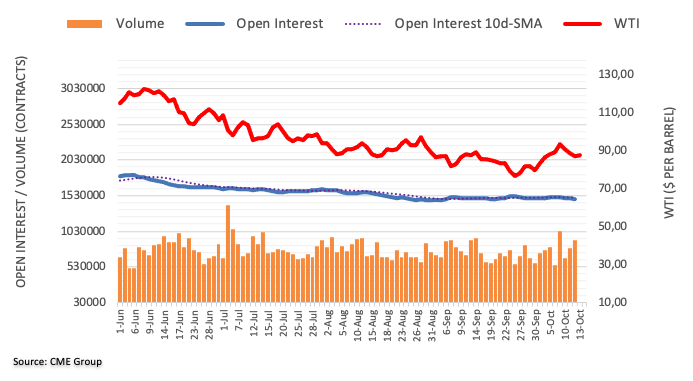

CME Group’s flash data for crude oil futures markets saw traders scale back their open interest positions by around 17.7K contracts on Wednesday. On the other hand, volume increased for the second session in a row, this time by nearly 111K contracts.

WTI: Next on the upside comes $93.00 and above

Prices of the WTI dropped for the third consecutive session on Wednesday. The downtick, however, was on the back of shrinking open interest, which hints at the idea that a deeper pullback seems not favoured for the time being. Bouts of strength, in the meantime, should target the October peak at $93.62 (October 10).